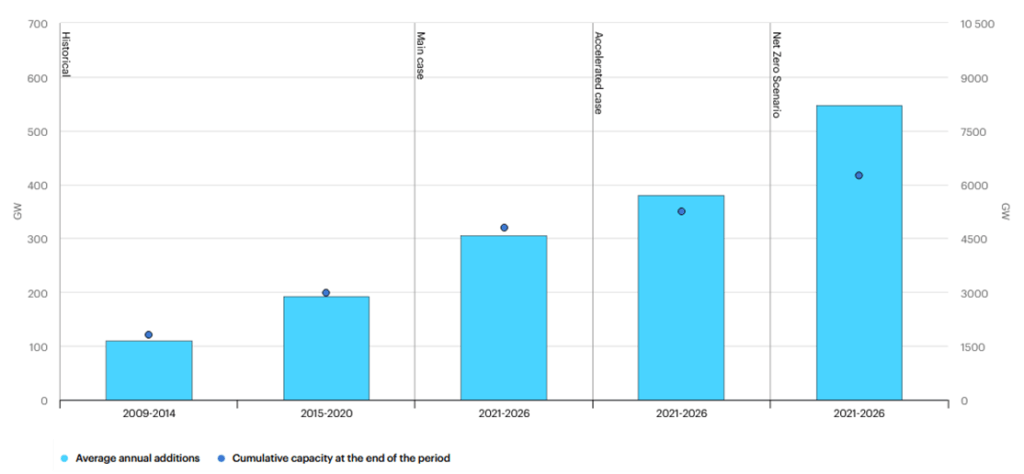

Annual additions to global renewable electricity capacity are expected to average around 305 GW per year between 2021 and 2026 according to IEA’s main case forecast. This implies an acceleration of almost 60% compared to renewables’ expansion over the last five years. Conversely, annual renewable capacity additions in their accelerated case are a quarter higher than in the main case, reaching over 380 GW on average over 2021-2026.

However, the gap between both the main and accelerated case forecasts and the trajectory necessary to meet Net Zero by 2050 remains significant. Annual capacity growth under the IEA Net Zero Scenario during 2021-2026 needs to be 80% faster than in the accelerated case, implying that governments need to not only address policy and implementation challenges but also to increase their ambition.

And whatever the reasons are (Invasion of Ukraine, lack of resources, speculation, etc), the fact is countries are not closing that gap:

- In the US, combined cycle plants produced 104,991 GWh in May of 2022, an increment of 8% compared to the same period last year. The electricity produced from natural gas rolling 12 months ending in May 2022 represents 38.3% of the entire national electricity mix.

- The current situation is causing coal-fired power plants to wake up again in some countries, which are seeing how their natural gas supplies are no longer assured. This is the case of the German government, which has announced that they will use more coal to reduce gas consumption, even though they approved a plan in 2020 to progressively abandon coal until its disappearance in 2038.

- In the US, electricity generation from coal from January to May of 2022 still represents 20% of the total electricity generation at utility-scale facilities.

- In China, the electricity demand between 2019 and 2025 is expected to grow by 1,250 TWh but the renewable additions will cover only 850 TWh

There is no Planet B but perhaps we are forced to look for a Plan B, as Net Zero Scenario is further and further and it may be naif to keep the same expectation.